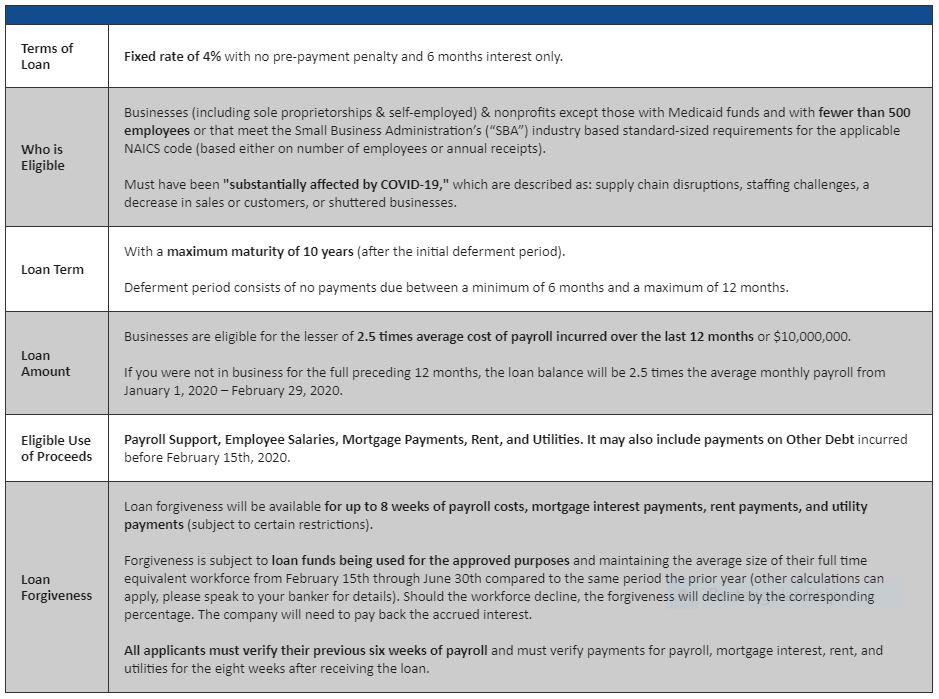

The CARES Act Paycheck Protection Program (PPP) is allocating $349 Billion to help small businesses that have been “substantially affected by Covid-19” (i.e., supply chain disruptions, staffing challenges, a decrease in sales and / or customers, etc.).

In addition to the loan, the CARES Act will grant Loan Forgiveness for up to 8 weeks between now and June 30, 2020 (see details below) for maintaining employees / payrolls during the crisis.

It is recommended that you apply through your regular lending institution / bank. If you are a member of a credit union that is not SBA-approved, you may apply below.

ONLY REQUIREMENTS:

- Less than 500 employees

- Established business before February 15, 2020

Businesses do NOT need to provide:

- Credit Score!

- Cash Flow Analysis!

- Tax Returns! (although Tax Form 941: Quarterly Payroll may be the easiest / best way to document / demonstrate payroll costs)

CARES Act Details:

- Employers can apply on Friday, April 3rd (including Sole Proprietors)!

- 1099 Workers can apply on Friday, April 10th (including Freelancers and Gig Workers)!

- Fixed Interest Rate of 0.5% (and no prepayment penalty with 6 months interest-only)!

- Maximum 10-year loans after deferment (6-12 months)!

- Loan Amount = 2.5 times the average cost of payroll!

- Loan Forgiveness up to 8 weeks!

- Must Apply for Loan Forgiveness at a later date (to demonstrate proper use of funds)!

Loan Forgiveness funds may ONLY be used for:

- Payroll costs

- Rent / Lease / Mortgage payments

- Mortgage Interest payments

- Utility payments

- Other debt incurred prior to 2/15/2020

It is recommended that you apply through your regular lending institution / bank. If you are a member of a credit union that is not SBA-approved, you may apply below.

Important Notes:

- Businesses can factor the average salaries and wages of all of their employees!

- Businesses can only factor the salaries of higher-paid employees up to $100K / year.

- Businesses can factor the average earnings of 1099 employees!

- Businesses can let employees go and still qualify for a CARES Act loan, but it will negatively impact (reduce) their loan forgiveness amount.

- Businesses can still apply for a CARES Act loan even if they have applied for other government loans, such as the SBA Disaster Relief Loan, but it may impact the loan amount!

- Business can qualify for loan forgiveness with both EIDL and the CARES Act IF the funds are used for different purposes (i.e., payroll expenses with the EIDL and other fixed expenses with CARES)!

- Business owners may apply for a CARES Act loan for each business they own!

- Businesses may not apply for a CARES Act loan more than once for the same business (i.e., via different lenders).

- Restaurants and Hotels may apply for a unique CARES Act loan for each separate location!

Need help? Don’t hesitate to ask. Biznis Resource has your back!

OTHER BUSINESS CAPITAL / FINANCE OPTIONS – CLICK HERE!

IMPORTANT TIPS: 1) Document all payroll costs, and 2) Create line items for each Covid-19-related expense (i.e., time spent on extra meetings, additional supplies purchased, increased cost of benefits. technology-related coping expenditures, etc.). Doing so will make it clean and easy to request / receive loan forgiveness and tax exemptions down the road!

The Consultation is FREE, so there’s absolutely no risk!

Re-source today with Biznis Resource… the better, easier way!

#disasterrelief

#businessloans

#loanforgiveness

#CARESact