The Small Business Administration (SBA) has announce the Economic Injury Disaster Loan (EIDL), which allows for up to $10,000 of Loan Forgiveness!

NOW is the BEST time to secure a Small Business Administration (SBA) loan! Unlike typical SBA Loans, you do not have to have a good credit score and collateral and positive cash flow (you only need one of the three)! Apply today, because the SBA Economic Injury Disaster funds will run out!

TERMS of the SBA Economic Injury Disaster Loan (EIDL):

- Long-term Loans (up to 30 years)!

- Low-interest Loans (3.75% for Small Businesses & 2.75% for Non-profits)!

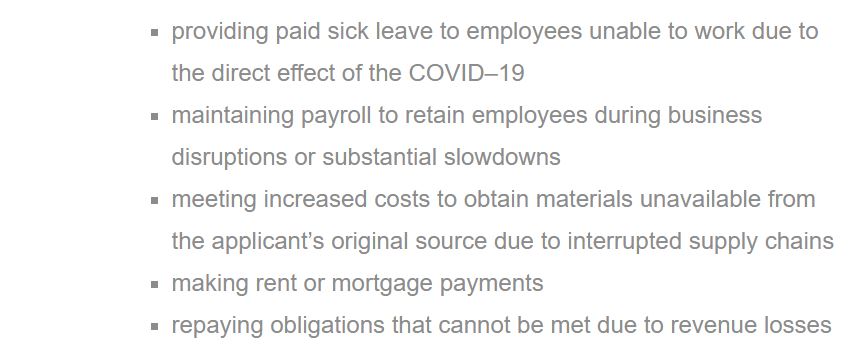

- Loan Funds must be used for:

DETAILS of the SBA Economic Injury Disaster Loan (EIDL):

- Small Businesses and Non-profits may apply!

- The Loan Application must be accurate, including: Contact info of all applicants, SS#s, EIN #s, and Insurance information.

- The Loan Application and ALL documentation must signed by every Principal owning 20% or more of the business.

- Required Documents (4) must be accurate and include:

- Form 4506-T

- IRS Form 8821

- Personal Financial Statement SBA Form 413

- Federal Income Tax return (most recent)

- Online Submissions generally result in faster approvals.

- The Loan deadline is 9 months after the disaster was declared (but may be extended).

- Loans may take between 60 – 90 days to process.

Currently, the following counties in Utah are eligible for Disaster Relief: Salt Lake, San Juan, Summit, Utah, Wasatch, Washington, and Wayne.

NEED OTHER BUSINESS CAPITAL / FINANCE OPTIONS?

IMPORTANT TIPS: 1) Document all payroll costs, and 2) Create line items for each Covid-19-related expense (i.e., time spent on extra meetings, additional supplies purchased, increased cost of benefits. technology-related coping expenditures, etc.).

The Consultation is FREE, so there’s absolutely no risk!

Re-source today with Biznis Resource… the better, easier way!