An OLO Builders Franchise is a system with all the processes, tools, and resources needed to build homes efficiently, profitably and generate delighted clients each step of the way.

The Power of Tapping into a System

BUSINESS VALUE INCLUDES (50K):

- Goodwill:

- OLO Builders Utah County

- New Franchise established 2022!

- Full transferability of franchise benefits including training

- New Home Construction

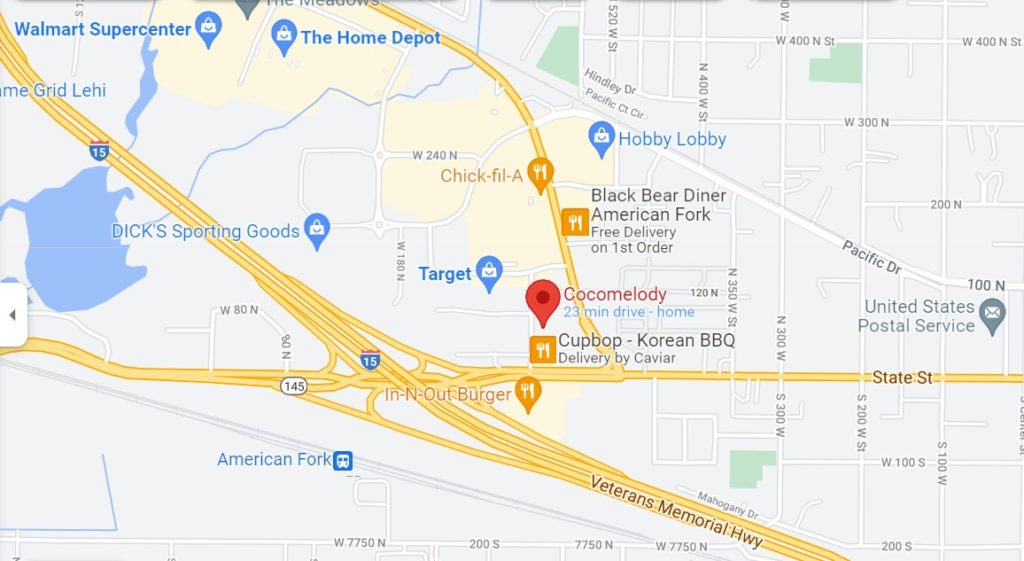

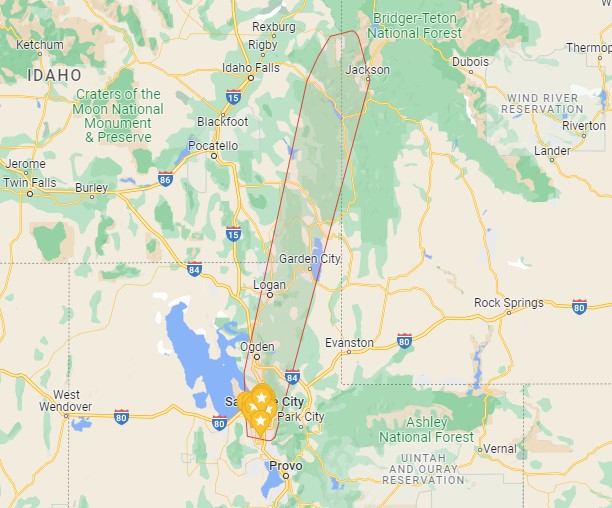

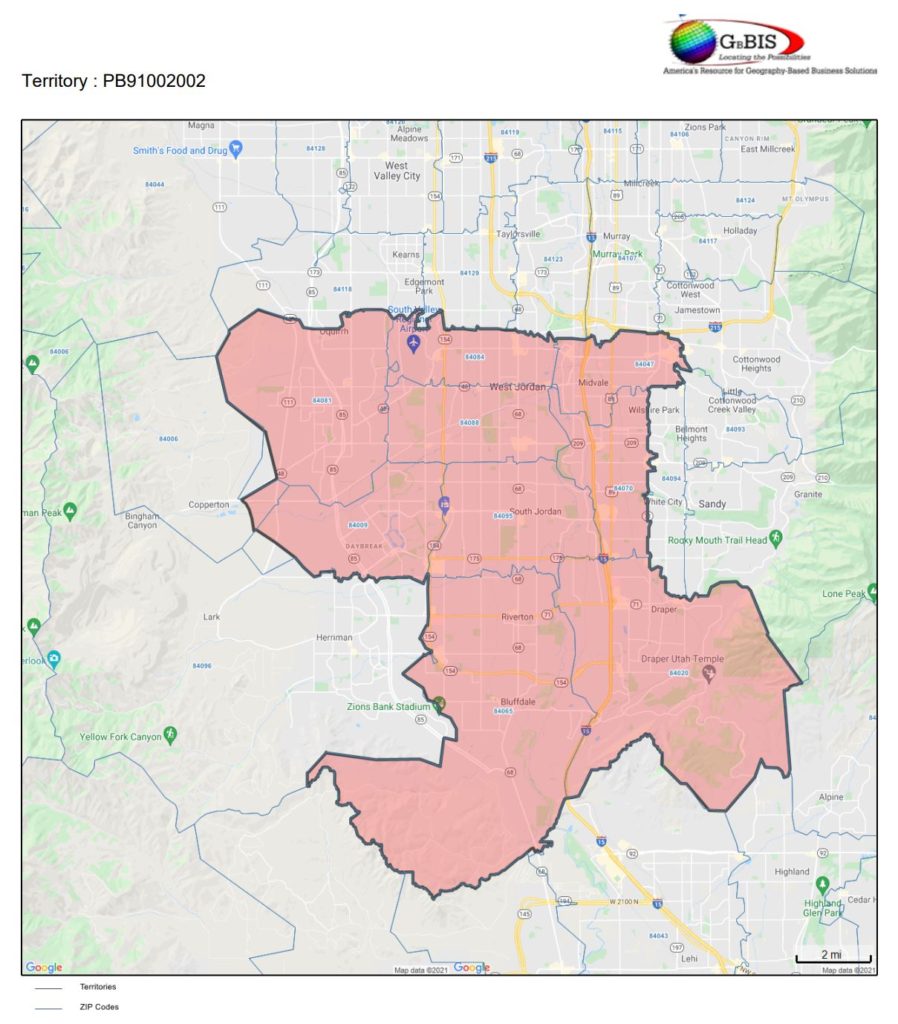

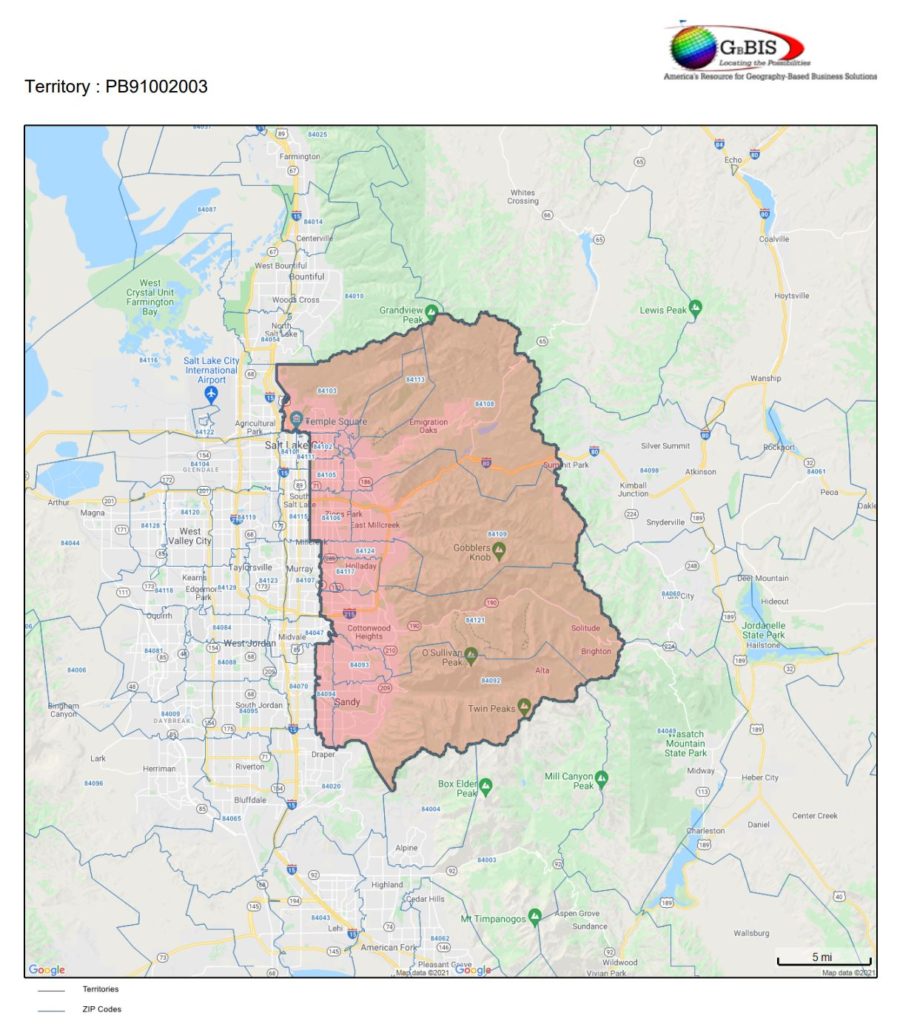

- Only OLO Franchise in Utah County

- Outstanding growth market

- OLO Builders Utah County

- Franchise Resources:

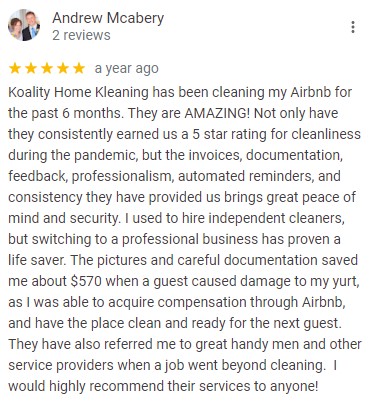

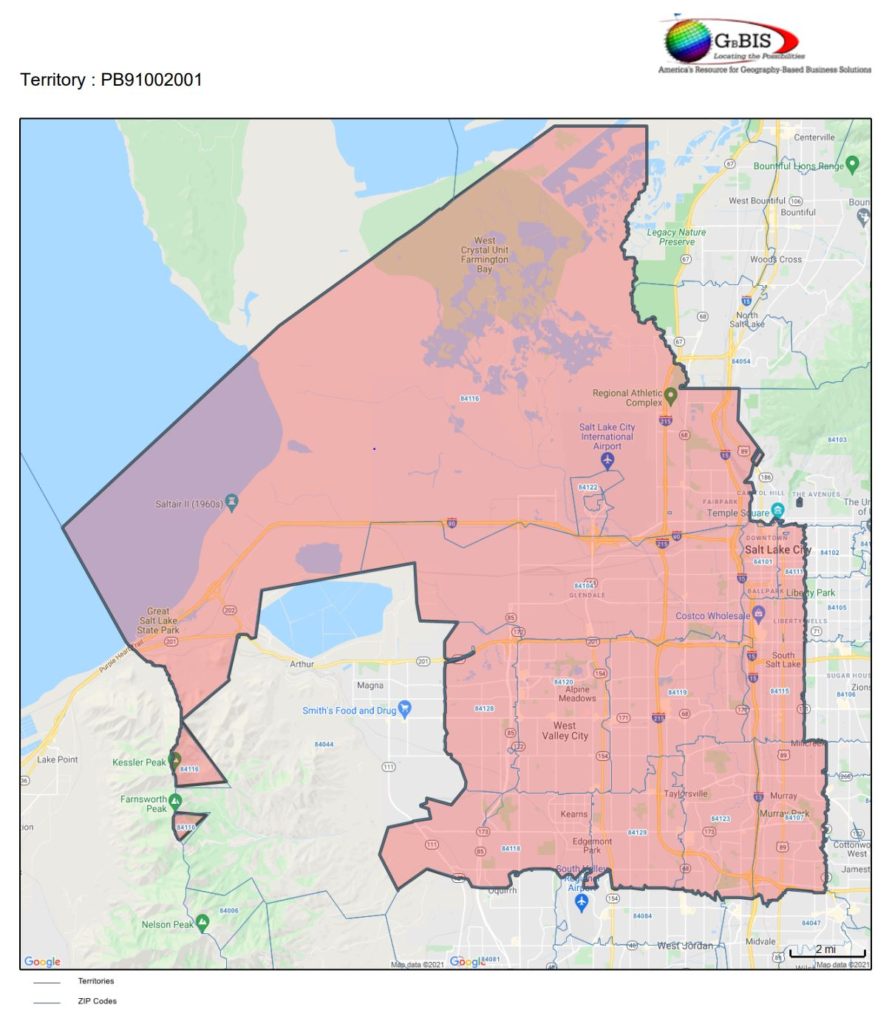

- Marketing- Targeted support from the national office

- 3rd-party relationships

- Banking

- Subcontrators

- Design

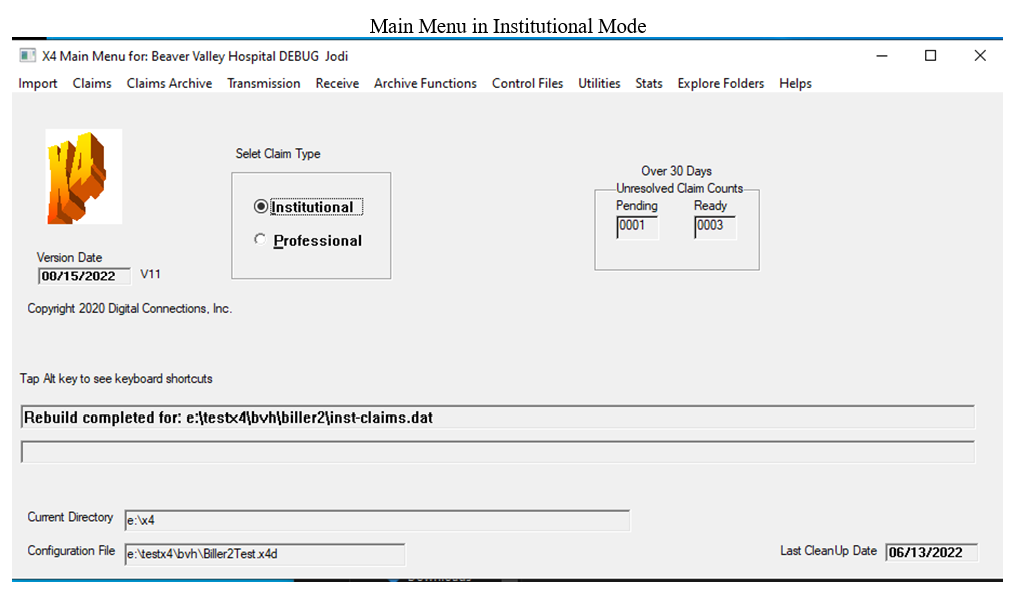

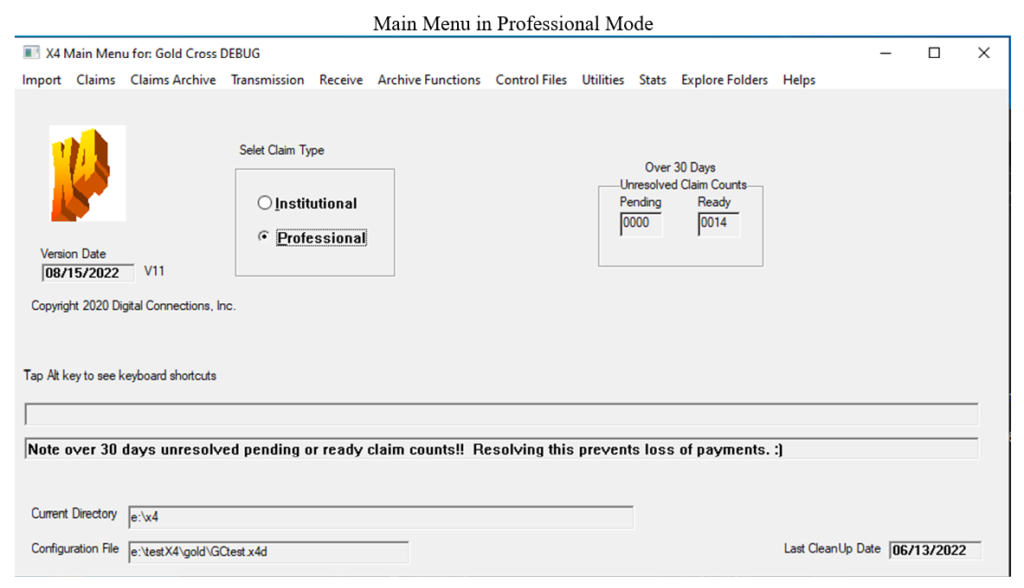

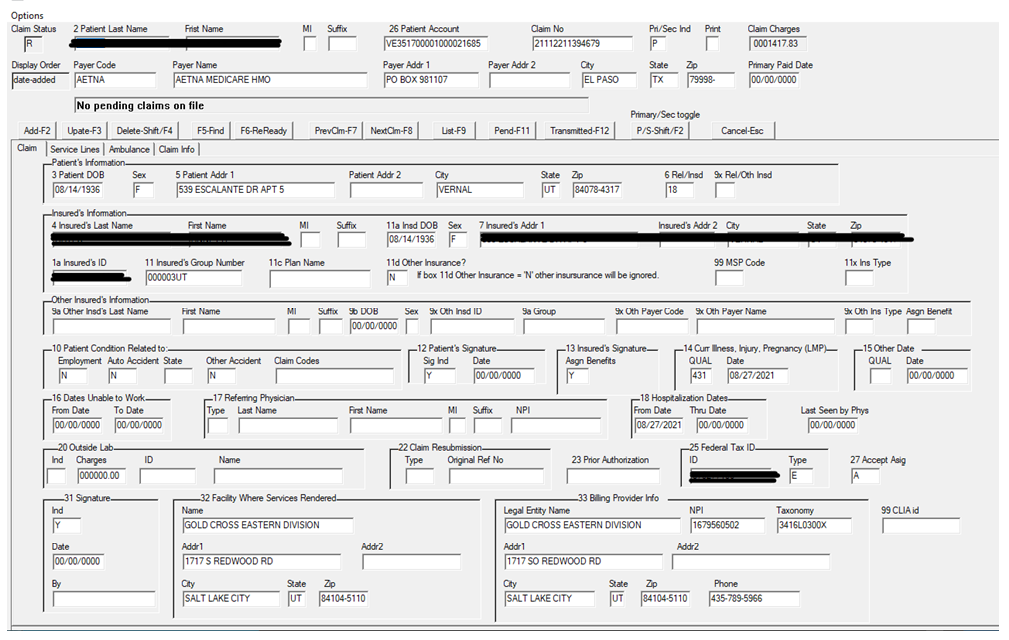

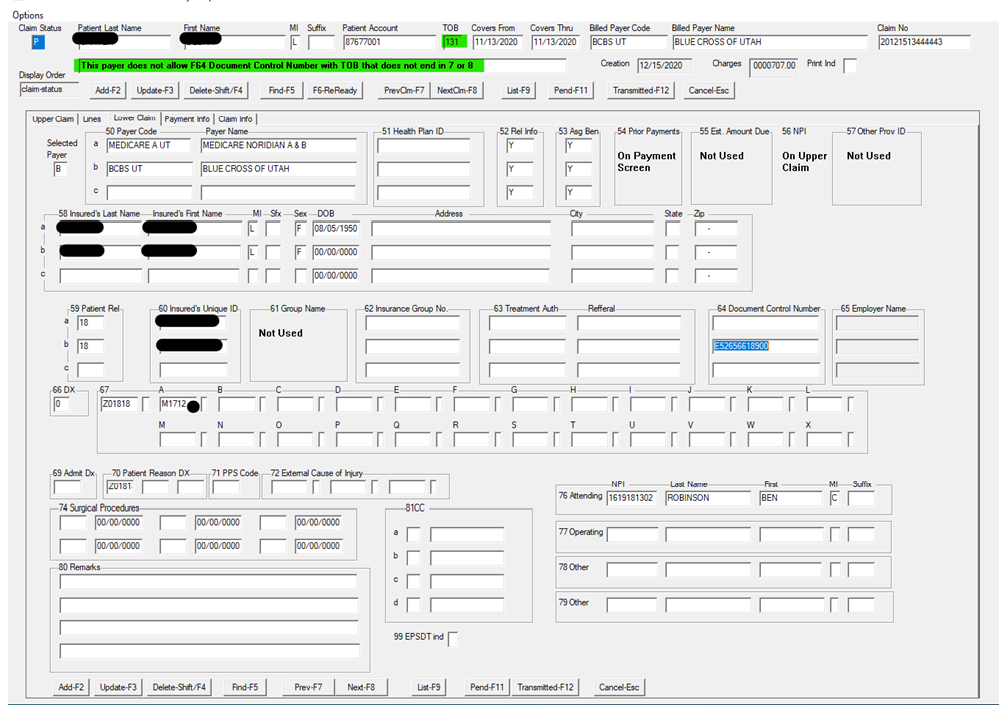

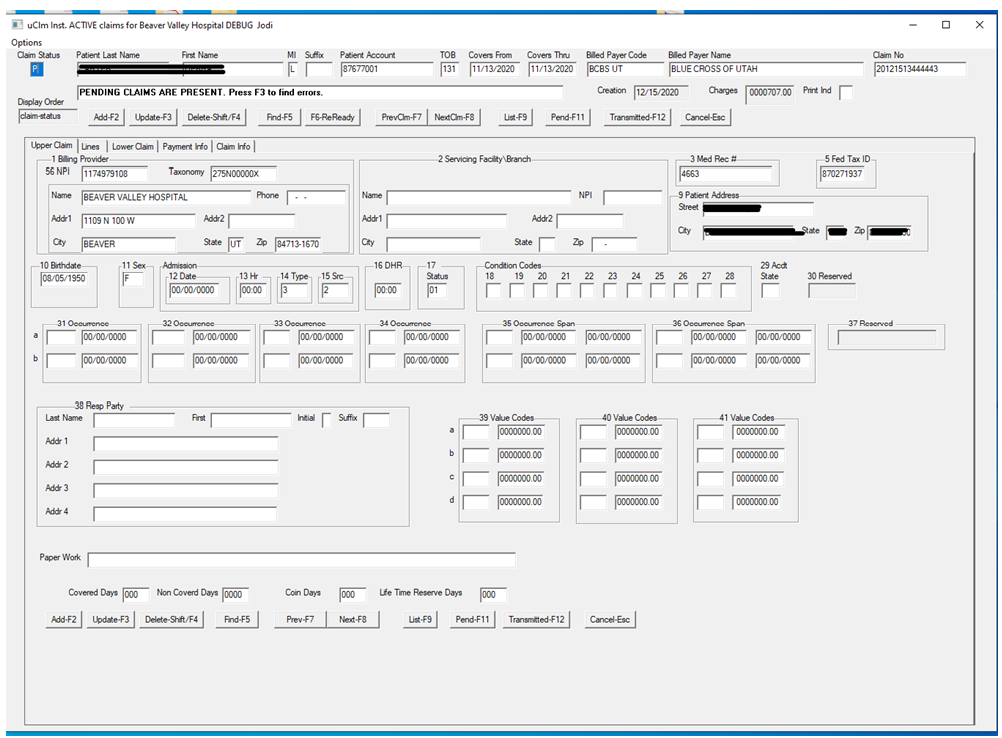

- Franchise software

- CRM

- Drawings database

- Project Management

- Online Presence:

- Website: Home – OLO Builders

- Franchise site: Home – OLO Builders Franchising

- Full Transition:

- All OLO Builders Franchise training is available to new owner!

An OLO Builders Franchise opportunity may be right for you if:

- You are already a builder, and you want to leverage/scale your business with a system and processes to help you be massively more efficient and profitable.

- You want to own a small builder company and would like to have less headache and risk compared to starting one on your own.

- You want to put your life’s effort into building a scalable, profitable business that can be sold one day.

Marketing services are provided to drive appointments; you receive floor plans to provide to your home buyers; you receive support from a national team – and you keep the profits.

OLO Builders provide designs and resources for quick and efficient builds to benefit the client and the builder.

OLO Builders has the amazing resources of a big builder, but we pride ourselves as a builder with a local presence that provides a personal connection to the client through the entire home building experience.

Inquire below for more info… this franchise will NOT last long!

The Consultation is FREE, so there’s absolutely no risk!

Re-source today with Biznis Resource… the better, easier way!