The COVID-19 Impacted Businesses Grant Program or “Shop In Utah” grant will provide $25 million primarily to small businesses negatively impacted by the COVID-19 pandemic (75% will go to businesses with less than 250 employees). The grant is administered through The Utah Governor’s Office of Economic Development (GOED).

Completed applications are accepted on a first-come, first-served basis and do not guarantee funding. The application window will only remain open as long as grant funds are available, so act fast!

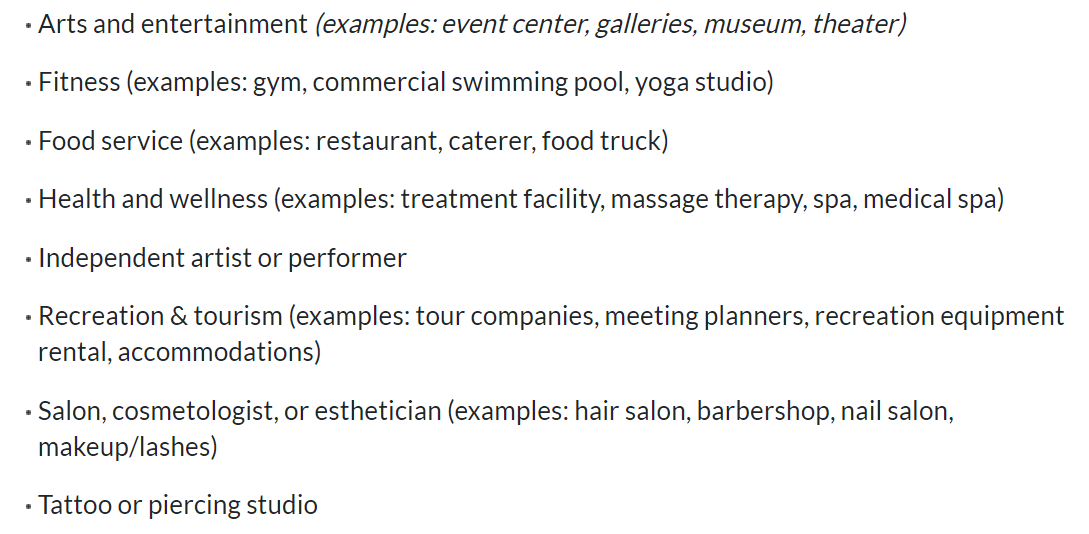

Eligibility Requirements:

- Have been in operation on March 1, 2020.

- Have employees physically located in Utah.

- Have experienced a revenue decline related to COVID-19.

- Offer a discount or other financial incentive with an estimated value to customers of at least 50% of the total grant amount (discounts, coupons, or other offers).

- Establish that the use of funds will benefit the state economy.

- Not receive funding from the COVID-19 Cultural Assistance Grant program (“Create In Utah” grant)

To determine the specific grant amount, business owners must first calculate their total lost revenues. Then businesses must provide a “Shop In Utah” customer discount or promotion to cover at least half of their total lost revenues.

For example, if a qualifying Utah business has lost $20,000 in revenue since the coronavirus pandemic began, it could create a discount or promotion worth a total of $10,000 in savings to its customers to qualify for and claim a “Shop In Utah” grant worth $20,000!

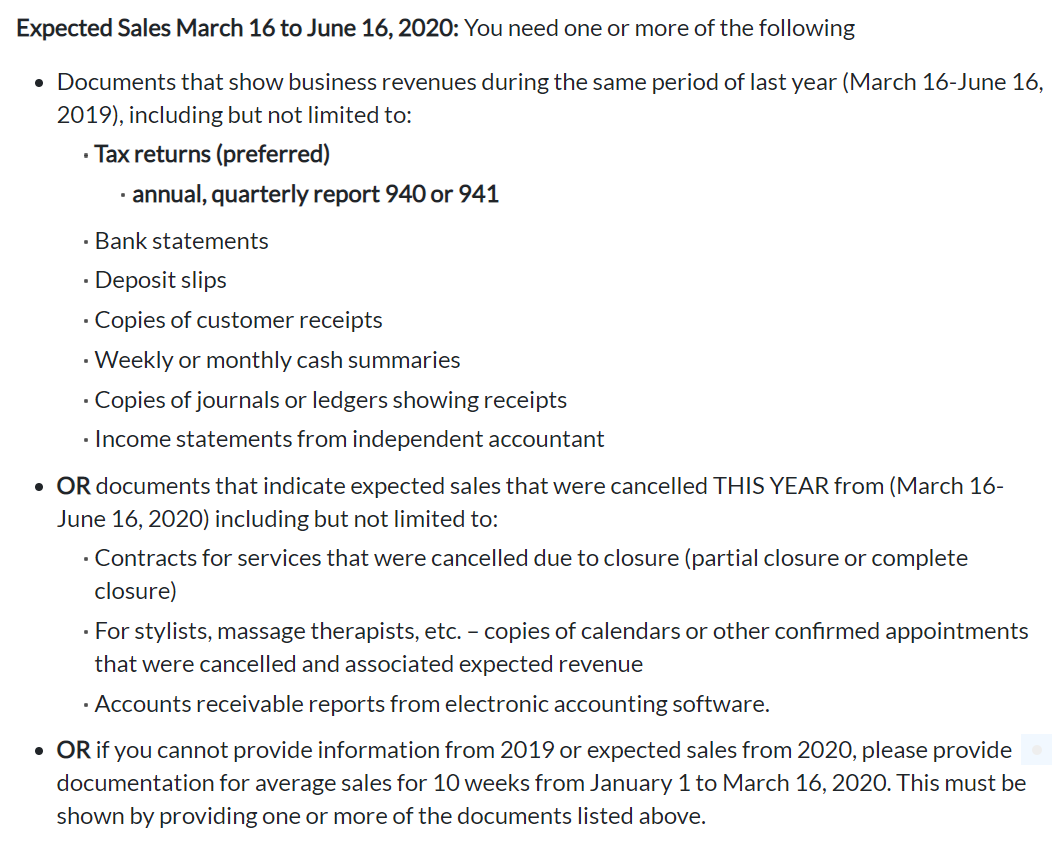

Required Documentation:

- A completed and signed W-9

- A Profit & Loss statement for March to June 2019 if the business began operating before July 1, 2019; or a February 2020 Profit & Loss statement if the business began operating on or after July 1, 2019

- A Profit & Loss statement for March to June 2020

- A plan that includes a budget for the financial incentive offer to customers; the budget must establish how the funds will be spent before December 30, 2020

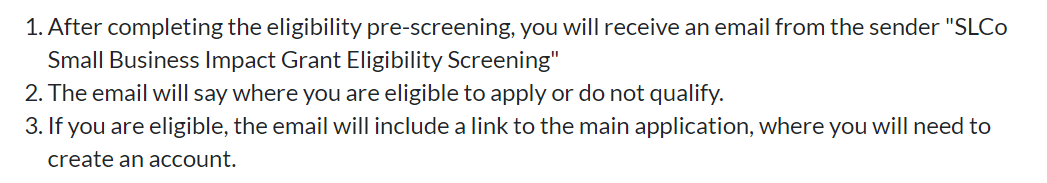

2-STEP APPLICATION:

1) Set-up a username and password with the GOED application system (Note: it can take up to 24-hours to receive credentials to access the system).

2) Log in to complete the application and upload supporting documentation (NOTE: If you applied for previous GOED COVID-19 grant programs, please use this application link and the same access credentials)

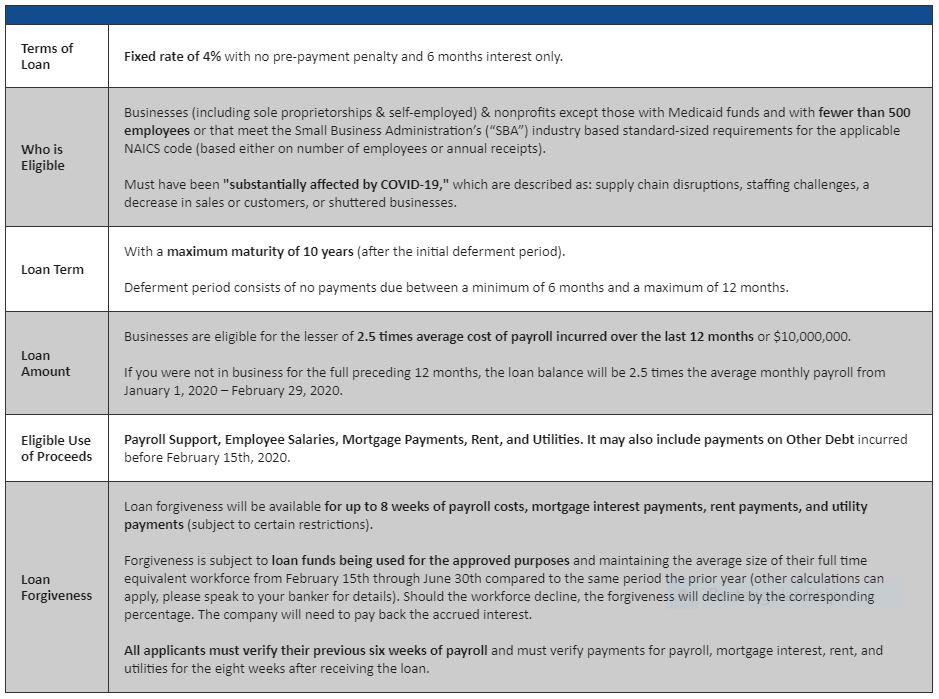

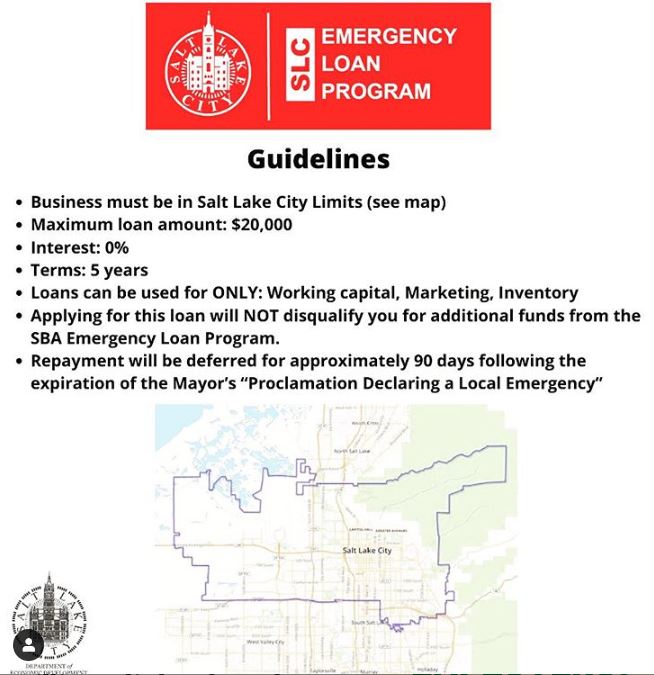

NEED OTHER BUSINESS CAPITAL / FINANCE OPTIONS?

IMPORTANT TIPS: 1) Document all payroll costs, and 2) Create line items for each Covid-19-related expense (i.e., time spent on extra meetings, additional supplies purchased, increased cost of benefits. technology-related coping expenditures, etc.).

The Consultation is FREE, so there’s absolutely no risk!

Re-source today with Biznis Resource… the better, easier way!