Painting With A Twist – Murray is an original paint and sip franchise. Painting with a Twist is a fun and engaging social outing that combines wine, fun and art.

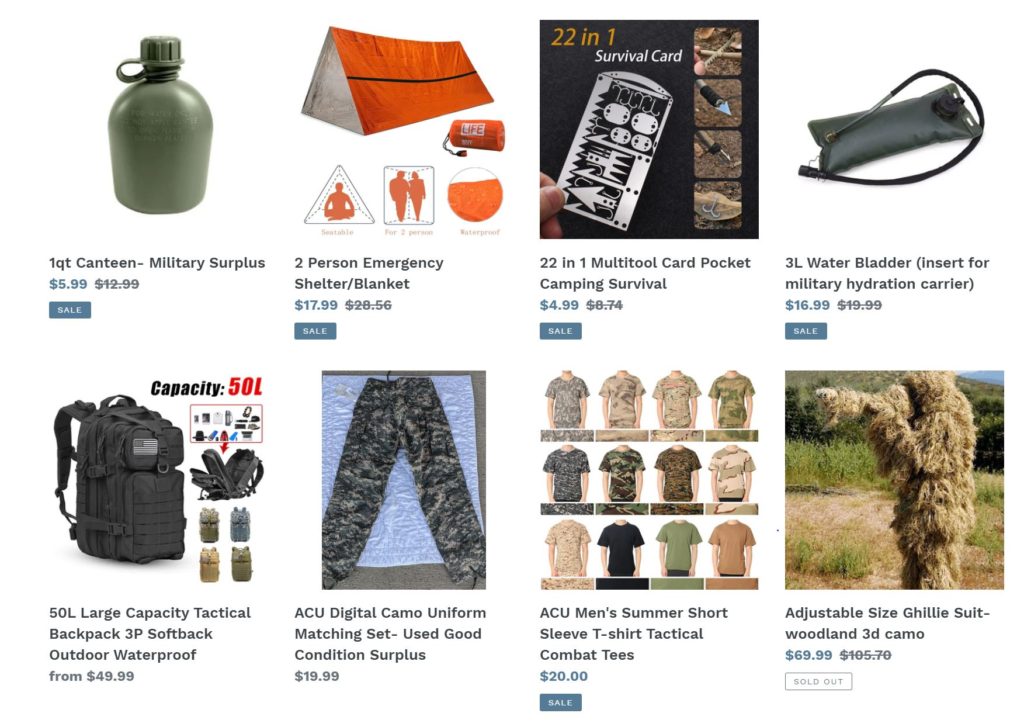

BUSINESS VALUE INCLUDES ($200K):

- Goodwill:

- 12-year Established Franchise

- Name Recognition: Over 230 Franchise studios in 39 states

- Monthly Events with Tinker’s Cat Cafe

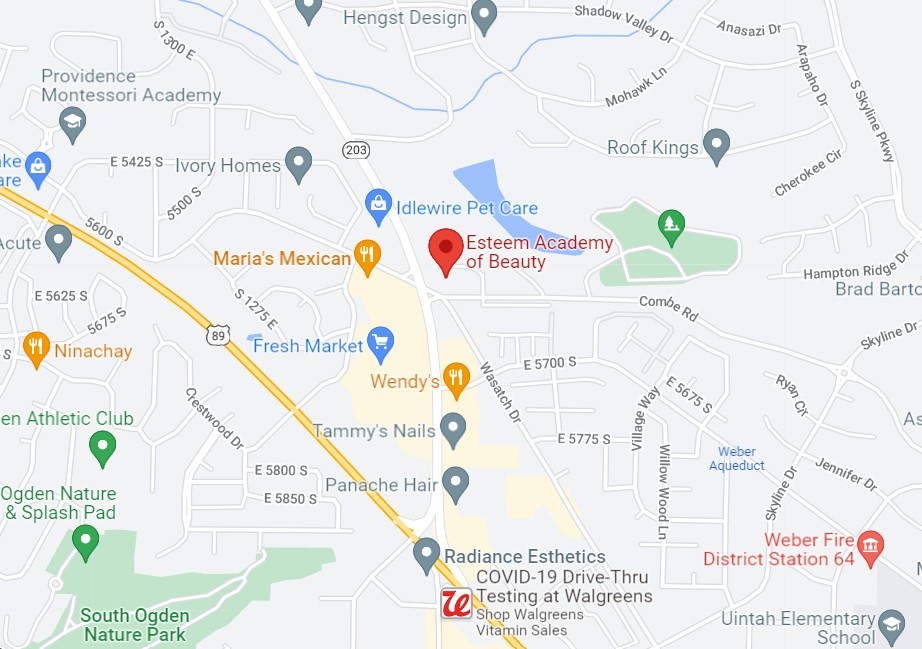

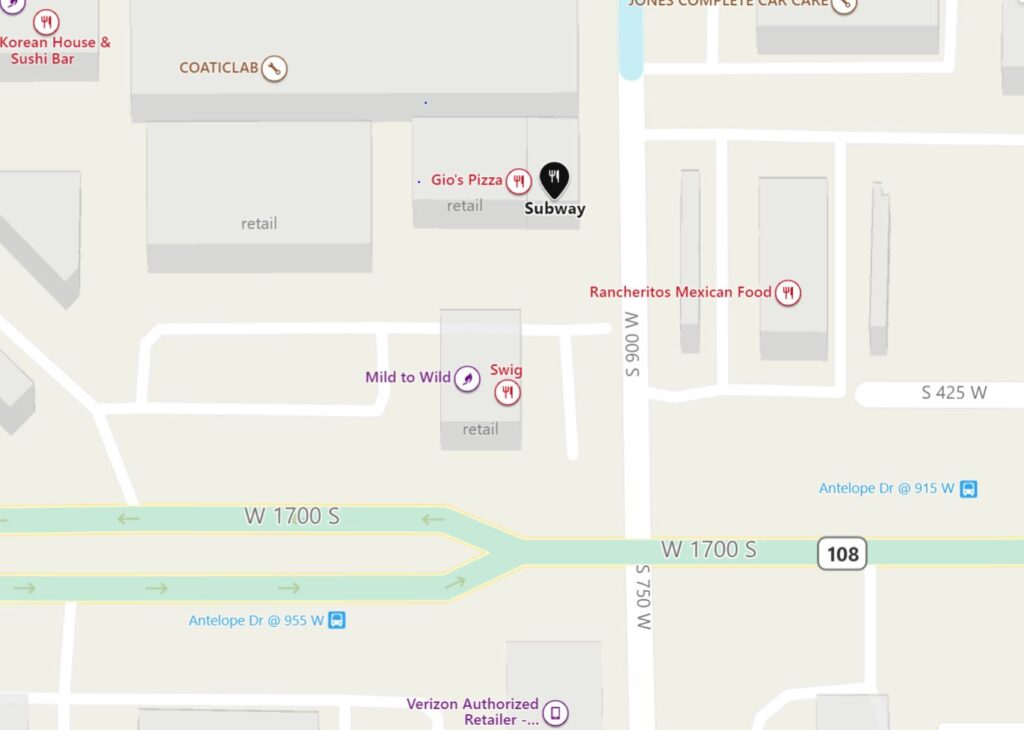

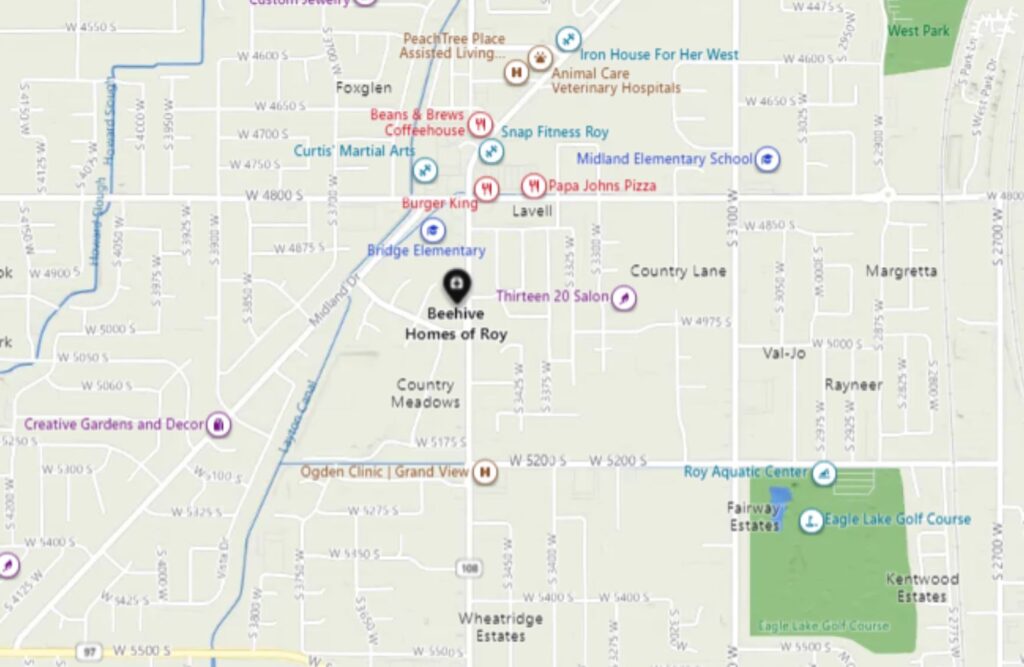

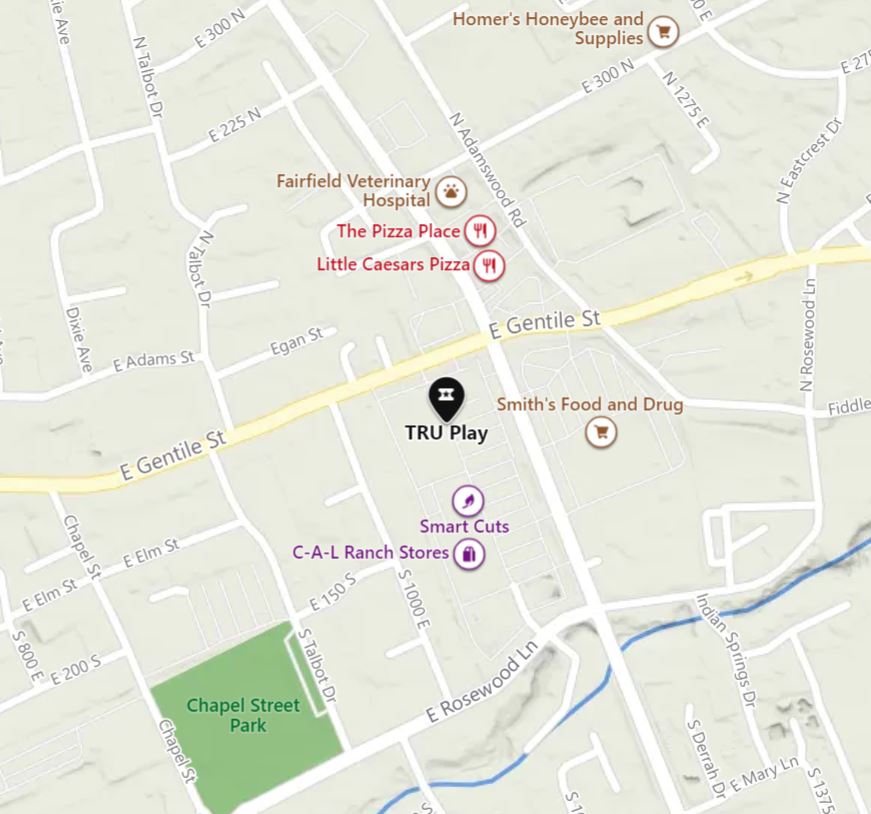

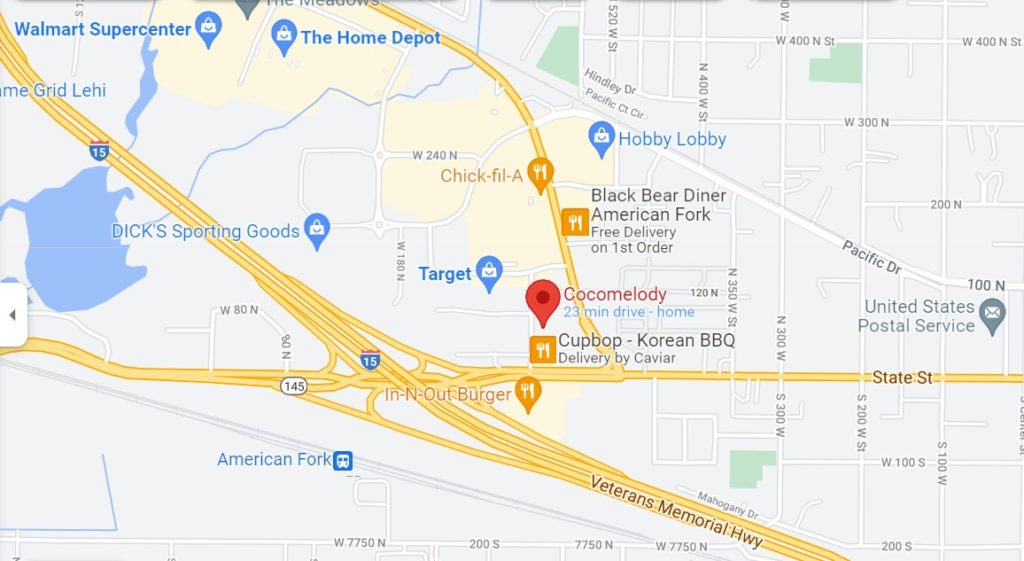

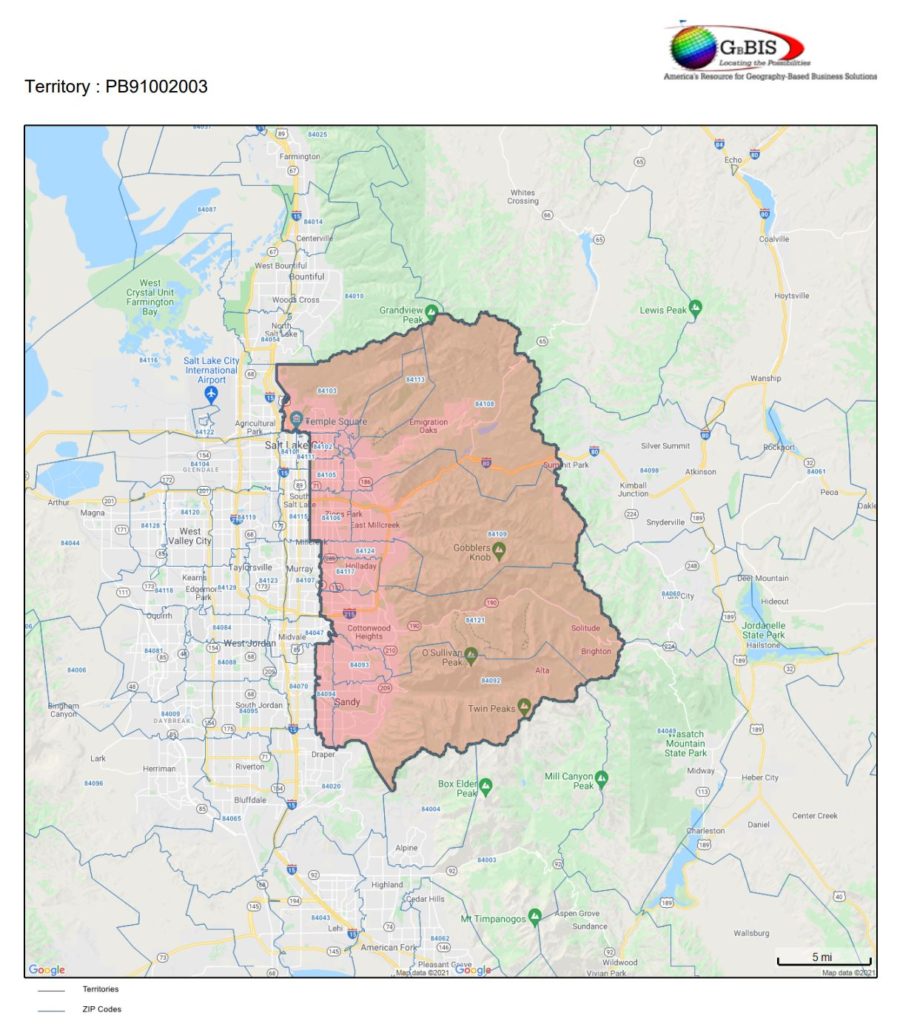

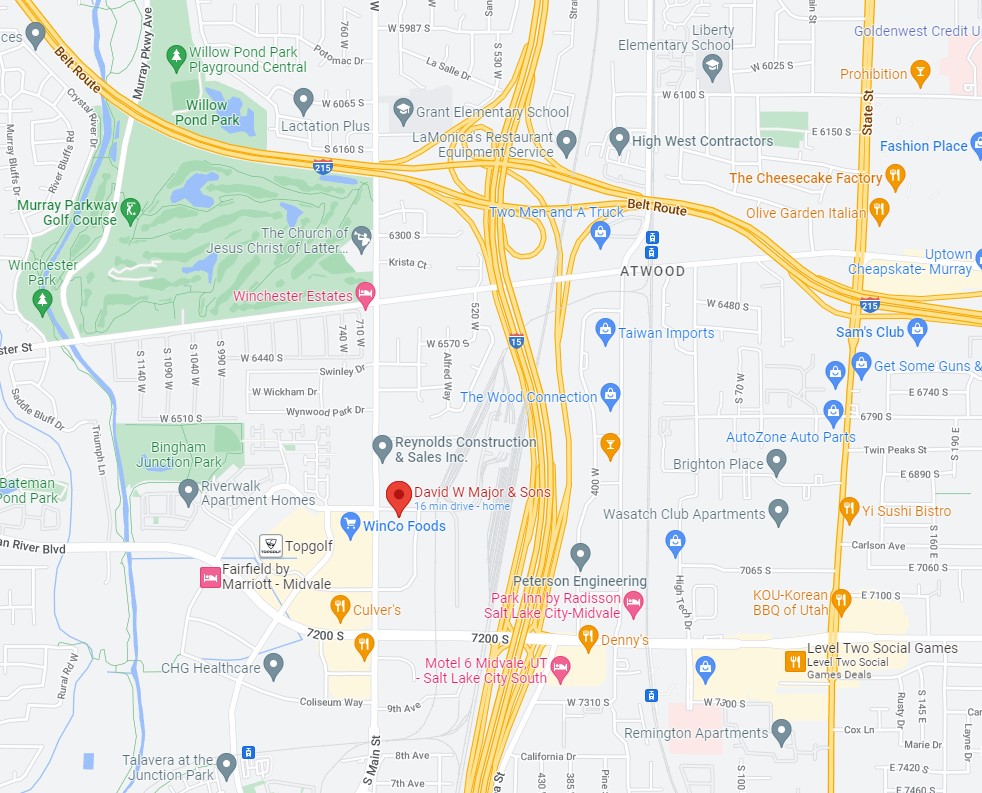

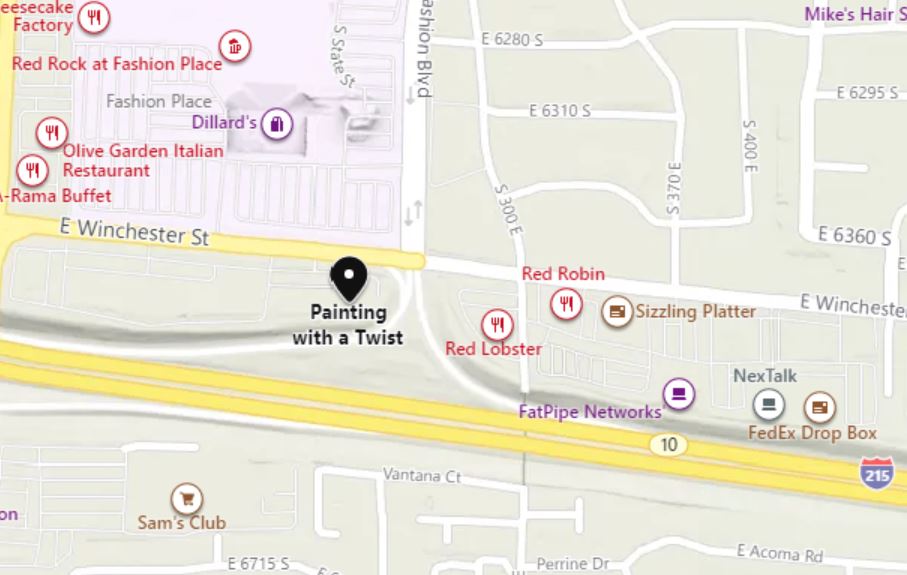

- Location:

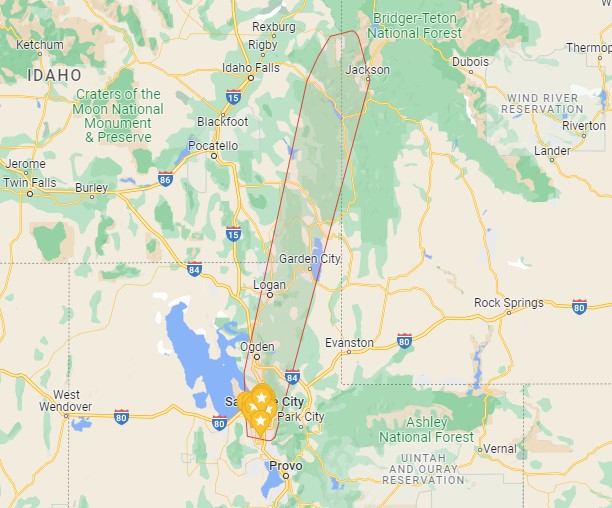

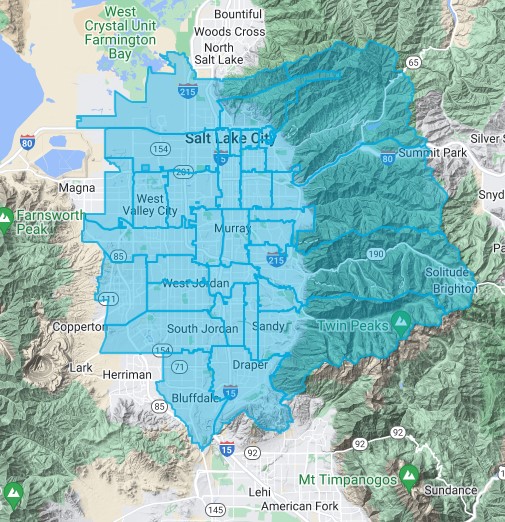

- 258 Winchester St, Murray UT 84107

- Square Footage: 1400 Sq Feet

- Main Party Room- seats 40+

- Private Party Room- seats 14

- Plenty of Parking

- Revenue Channels:

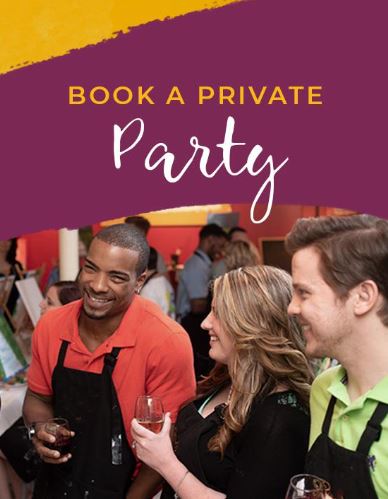

- Large or Small Private Parties

- Girls Night

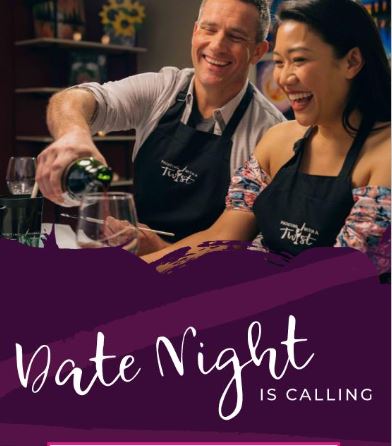

- Date Night

- Public Events

- Trivia Night

- Corporate Events

- Team Building

- Large or Small Private Parties

- Hard Assets:

- FF&E = $10K

- Inventory = $5K

- Online Presence / Soft Assets:

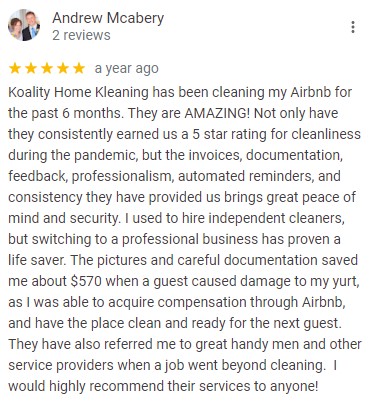

- Google My Business: 400+ Reviews, 4.9 Stars

- Website: https://paintingwithatwist.com/studio/murray/

- Facebook Business: 300+ Reviews, 15K followers

- TikTok: 22K + Likes

- 7700+ opted-in email contacts for marketing

- Marketing:

- Campaigns: 7000-8000 email list

- Franchise marketing – social media & TV ads

- Employees:

- 2 Part-time Managers: 10-15 hours weeks (each)

- 1099 Employees: 8 contractors

- Lease:

- Rent: $1755

- Month to month

- CAM: $600

- Rent: $1755

- Full Transition:

- Franchise transition and training available

- Technical & business training negotiable

Painting with a Twist is the original girl’s night out with a twist. We are the largest, fastest-growing brand in the category we pioneered. In franchising, the largest and most experienced brands in a category offer franchise owners the best tools, experience and value, translating into the best opportunity for success.

You don’t have to be an artist to be an owner. You don’t have to have franchising experience. You do need to be someone whose idea of fun is being very involved in your local community.

Being the leader and largest in our industry, Painting With A Twist-Murray has the volume buying power to obtain lower cost of goods, which contributes to stronger unit economics.

Inquire below for more info… this franchise will NOT last long!

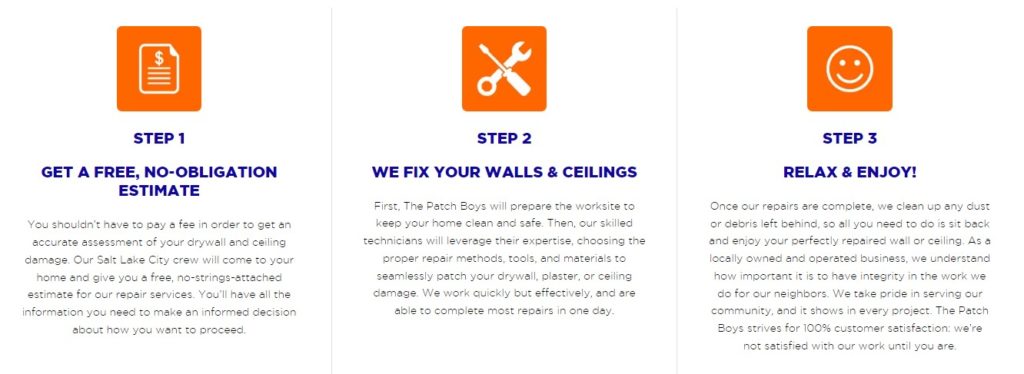

The Consultation is FREE, so there’s absolutely no risk!

Re-source today with Biznis Resource… the better, easier way!