The Small Business Impact Grant (SBIG) is a COVID-19 relief program for small businesses in Salt Lake County. A total of $40 million will be dispersed!

ELIGIBILITY PRE-SCREENING: APPLY HERE!

This one-time Grant of up to $35,000 per applicant will be awarded to eligible businesses applying for funding. Applications will be accepted until all of the funds are exhausted.

ELIGIBILITY REQUIREMENTS – Businesses must:

- Be based in Salt Lake County

- Employ fewer than 100 employees

- Not have already received federal, state or local COVID-19 financial aid

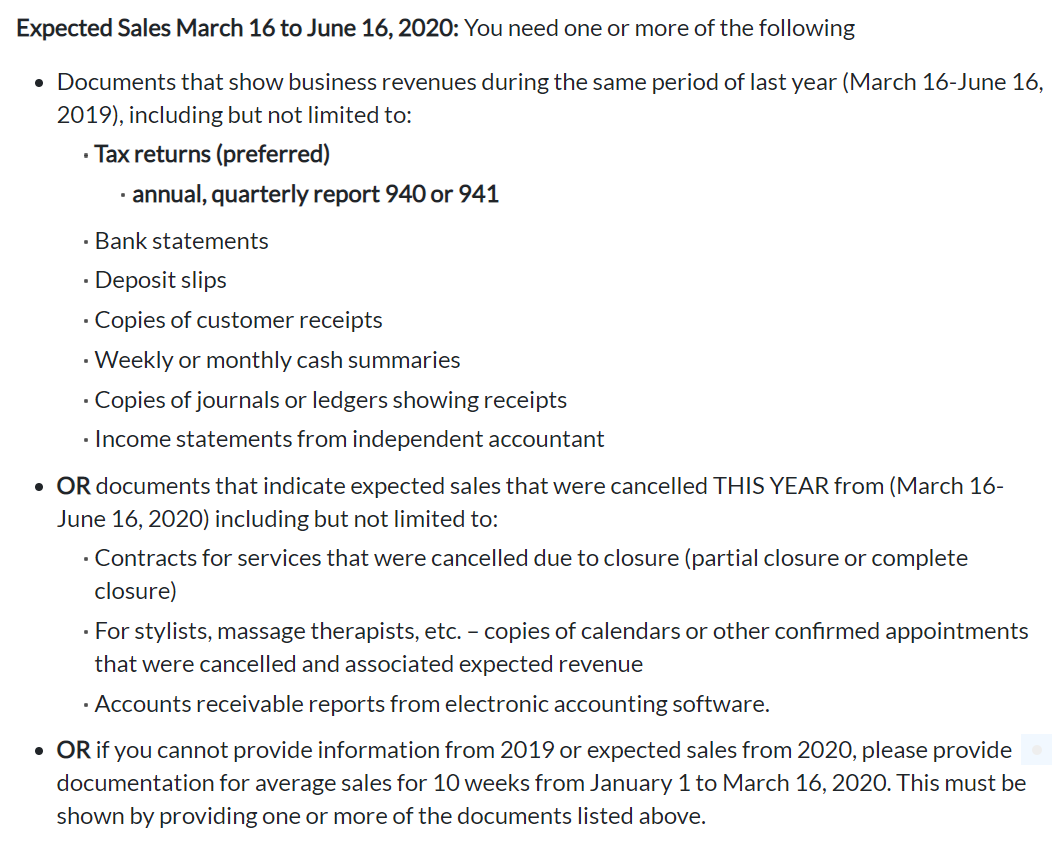

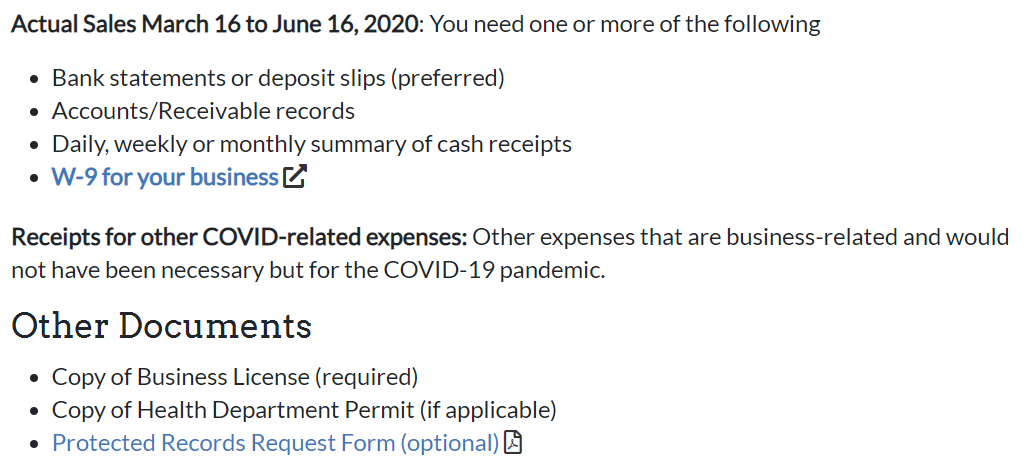

- Provide documents verifying your financial loss

- Have operated prior to Jan. 1, 2020

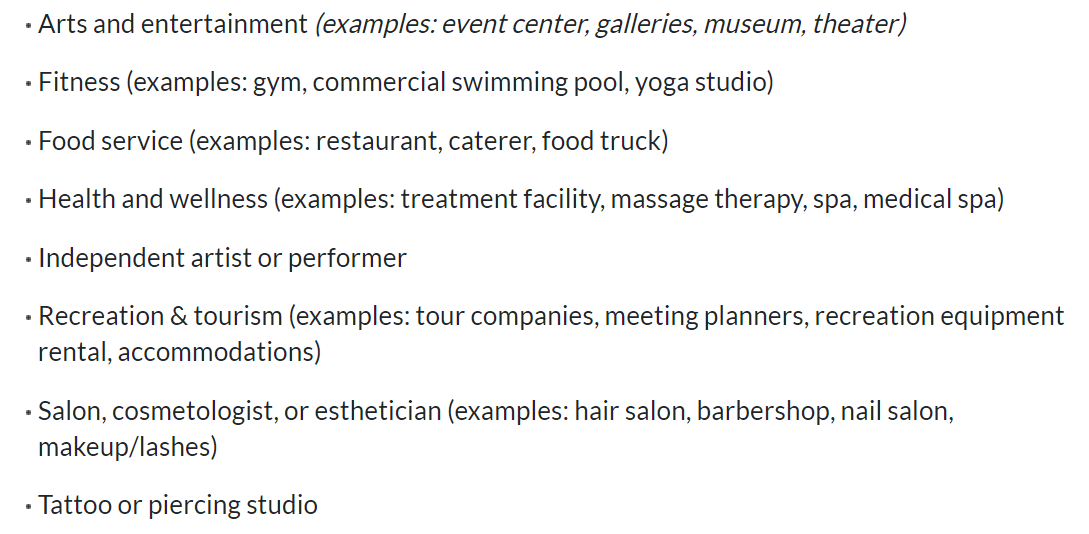

- Be primary industries impacted directly by public health order closures (see below)

Qualifying Businesses May Include:

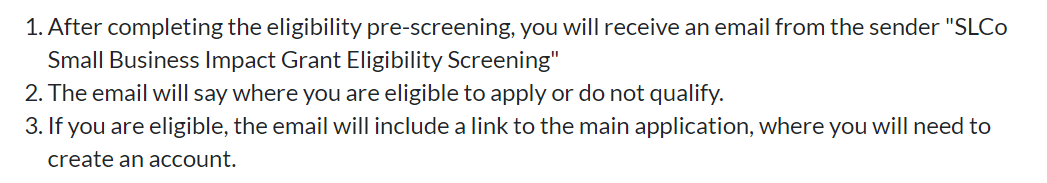

HOW TO APPLY:

ELIGIBILITY PRE-SCREENING: APPLY HERE!

REQUIRED DOCUMENTS INCLUDE:

Biznis Resource has your back!

NEED OTHER BUSINESS CAPITAL / FINANCE OPTIONS? CLICK HERE!

The Consultation is FREE, so there’s absolutely no risk!

Re-source today with Biznis Resource… the better, easier way!